By Mark Baker, Sales Effectiveness, Nielsen

When a popular trend takes a market by storm, it’s tough to not want to go all in on it. There is, however, something to be said for having too much of a good thing. And in many ways, having too much of a good thing can actually have a negative effect on category sales.

Think of it this way: offering consumers an array of 10 potato chip brands that all feature the same primary ingredients and flavour profile is a good way to choke your return on investment at the shelf. Yes, brand disloyalty is at an all-time high, with only one-in-10 New Zealanders considering themselves loyal to grocery brands. Having said that, loading up a shelf with an array of similar products isn’t the answer. That will simply cannibalise your category sales.

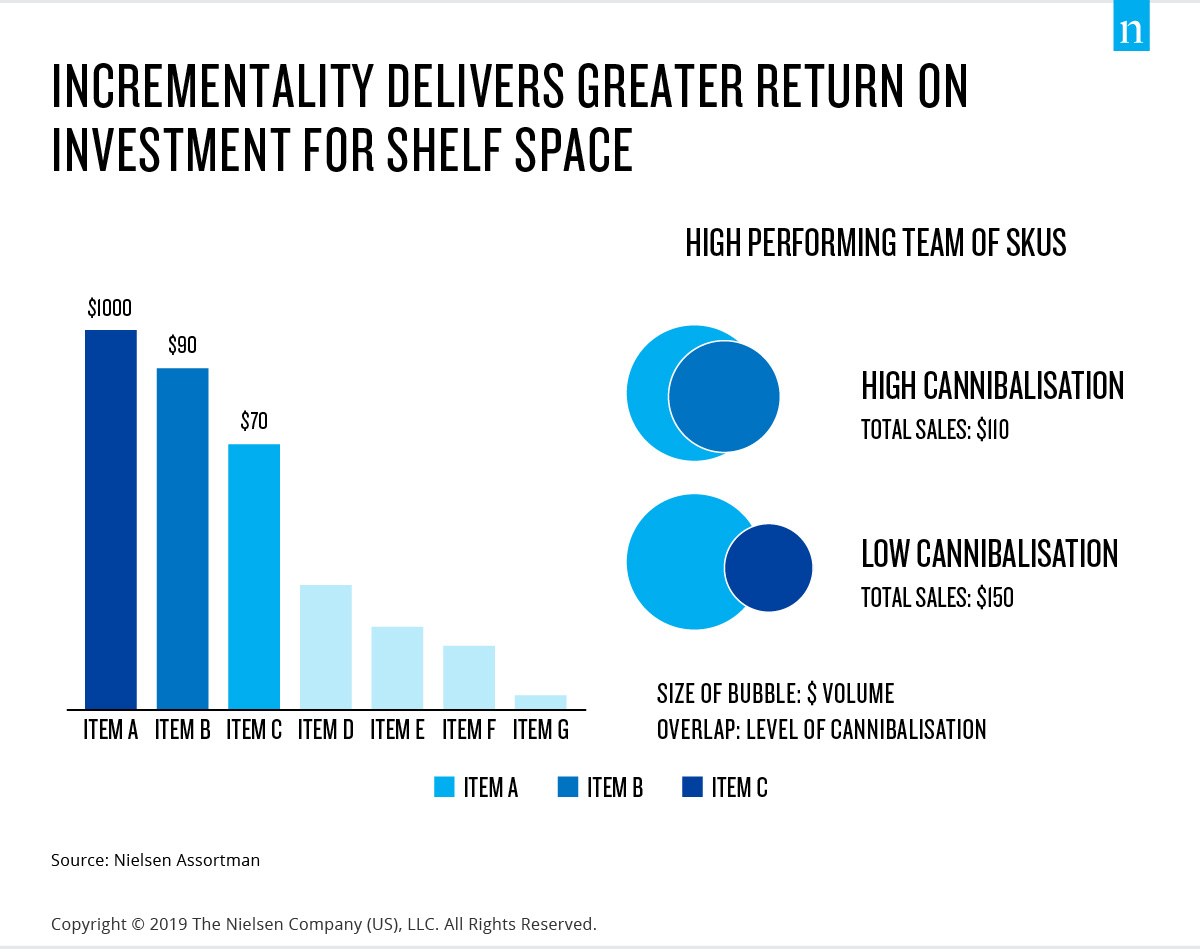

When you consider that shoppers spend just 15 seconds looking for items on a store shelf, it’s even more important that product assortment hits the mark. And incrementality is a powerful way to both offer variety within a category and maximize ROI at the same time.

To illustrate, let’s dig into the topic of incrementality using the potato chip example. If a retailer only stocks the potato chip aisle with ready-salted chips, the most popular flavour, the products will all compete for the same sale, restricting category sales growth. But when a grocer offers additional product variants, like salt and vinegar and sour cream and chives, consumers are enticed to make incremental purchases within the category.

This is where assortment analytics come in. They help retailers identify the most efficient, profitable and high-performing groups of products to increase incremental sales potential for a category.

FOREWARNED IS FOREARMED

But what about getting products to the shelf? Incrementality is just as important to manufacturers as it is to retailers, given every brand’s desire to defend the space that their products maintain on the shelf. That’s why it’s important for manufacturers to critically assess their lines by answering two key questions:

- “Is my rate of sale high enough?”; and

- “Is my product unique enough to add value to the category?”

The answers to these two questions help suppliers understand the potential risks with their product portfolios while allowing them to forward-plan and focus their new product development decisions and direction. Is a squeezable bottle as important as a sugar-free variant? Where does caffeine-free factor into a shopper’s decision? Is adding another 1-litre variant to the range going to reduce sales by further confusing the category?

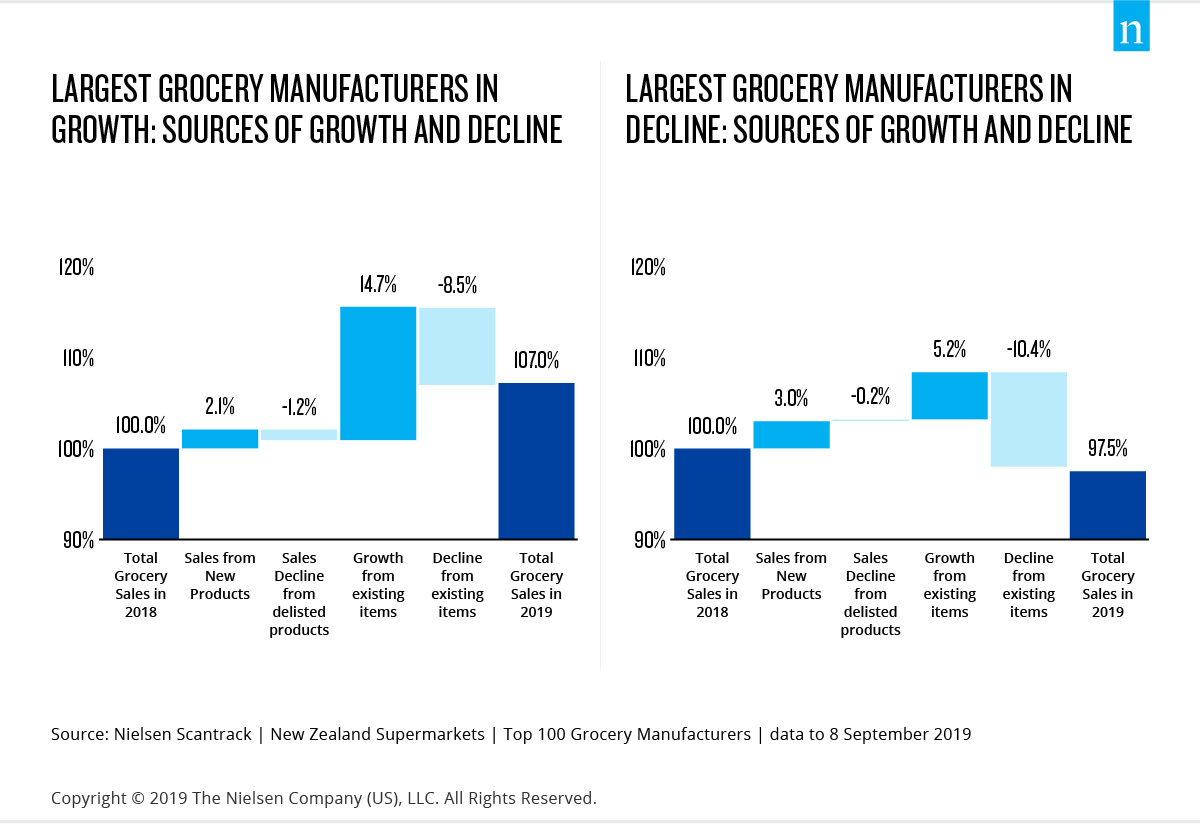

By addressing these questions, brands are taking greater ownership of their brand destinies. Brands are doing this by proactively reviewing their ranges, replacing poorly performing items with products that build category potential, requesting options to increase trade support in segments that are under pressure, among other tactics. Having this information on-hand also helps avoid the removal of products that may not rank highly, but deliver truly incremental value to shoppers. Even among the top 100 largest manufacturers in New Zealand’s grocery sector, some suppliers show good category stewardship by regularly supporting the growth of existing items, delisting items that restrict growth and introducing new products to stimulate growth. On the other hand, some suppliers don’t have the right mix of items in their portfolio, causing sales declines in their respective categories.

Retailers want a profitable combination of products that are easy to understand and deliver a simpler choice and greater value for shoppers. Manufacturers that consistently pursue this are better positioned to own their brand destiny and drive more profitable sales growth for their categories. As a manufacturer, understanding how categories are shopped and how individual items perform within that category will arm you with the information for more collaborative decision-making with your retailer partners.

ABOUT ASSORTMAN

Our assortment optimisation tools show how much of each SKU’s volume is incremental to its segment and its category, as well as how much volume reflects a switch from other products. This is the key information to help you maximise segment and category sales for any size shelf in your store and for any retailer that stocks your products.