The four groups influencing spending in New Zealand

Larissa Watson, Consumer Intelligence Lead at NielsenIQ

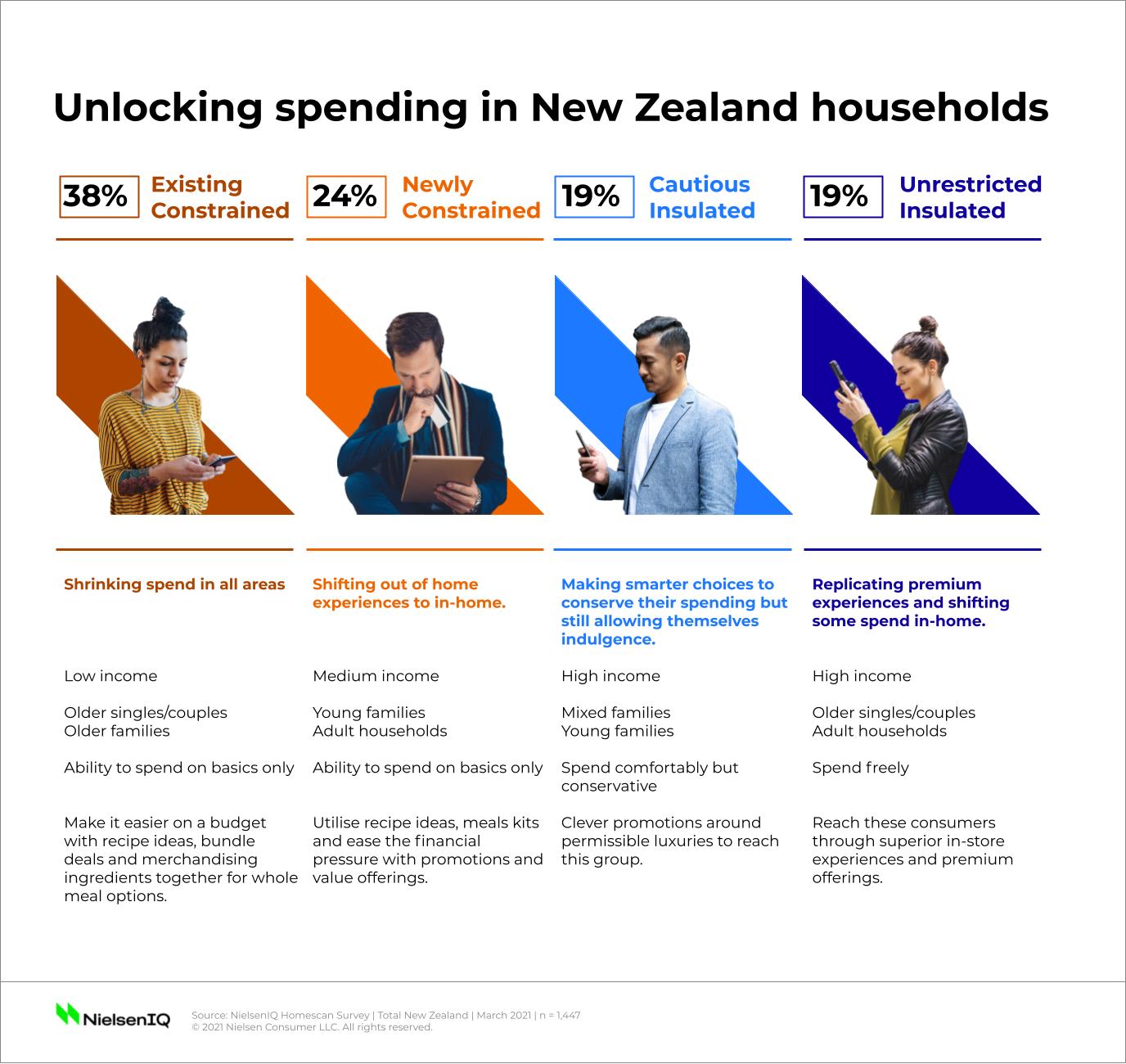

Whilst New Zealanders have more or less returned to normal living in a post-COVID world, the way Kiwis shop has irreversibly changed. There are two seismic shifts that call for a deeper understanding of shopper behaviour – the changing financial situation for Kiwi consumers and the disappearance of 3.8 million annual tourists. One year on from the rise of the pandemic, four distinct groups have emerged which are driving spending patterns in New Zealand today.

Existing Constrained are lower-income households who were already watching what they spent pre-COVID. Now, they continue to scrutinise their spending by looking for promotions and value. They look for convenient meal options in categories like mexican foods, frozen fish, chicken and pizza, pasta and sauces. These consumers are all about ‘making things easy on a budget’. Recipe ideas, merchandising meal ingredients in one place and bundle deals appeal to this group.

Newly Constrained households experienced the greatest impact to their income and financial situation leading to significant changes in their shopping habits. These consumers are more likely to be young families and single households who are switching their out-of-home (OOH) spend to in-home spend in two major ways – buying more staple items to cook and bake from home, while substituting some of their OOH experiences and indulgences by buying products like wine and beer, chilled meats and cheeses. More than half are looking for more price promotions and value in-store and online as they scrutinise their spend more closely. To cater to this group, it’s important to ease their financial pressure by meeting their basic needs whilst giving them opportunities to feel like they have something left over to treat themselves. Use recipe ideas, meals kits and a balance between private label and proprietary products to offer them ‘good, better, and best’ options.

Cautious Insulated households saw a limited impact to their income and financial situation. Even so, they continue to make smarter choices to conserve their spending. These consumers are shifting some of their habits in-home and allowing themselves permissible indulgences as well as healthier in-home options. They are spending more in categories like wine, confectionery, fresh convenience meals, fresh & frozen poultry and salads & salad dressings. It’s important for this group to feel that they are getting the most value from their food and grocery spending. Clever promotions for permissible luxuries are one of the best ways to appeal to this group.

Unrestricted Insulated households are less concerned and continue to spend freely. They tend to be higher-income singles and couples who did not experience a change to their financial situation. Whilst they largely maintained their shopping behaviour, they are increasing their spend on in-home indulgence and convenience meals. Retailers and manufacturers can cater to these consumers through superior in-store experiences and premium products that offer them good substitutions for OOH solutions.

The motivations for each of these groups, and the ways they make decisions, are different. If you need a better handle on how consumers are shopping in your categories and for your brands, contact nzhello@nielseniq.com.