In the latest Nielsen Global Survey of Consumer Confidence and Spending Intentions, New Zealand consumer confidence remained stable in the first quarter at an index of 99, just below the optimism baseline score of 100. The score of 99 did not change from the previous quarter (Q4 2015) and declined three points from 102 a year ago (Q1 2015).

In the latest Nielsen Global Survey of Consumer Confidence and Spending Intentions, New Zealand consumer confidence remained stable in the first quarter at an index of 99, just below the optimism baseline score of 100. The score of 99 did not change from the previous quarter (Q4 2015) and declined three points from 102 a year ago (Q1 2015).

In Australia, confidence declined seven points to 89, as all three consumer confidence indicators (job prospects, personal finances and immediate spending intentions) declined in the first quarter (see chart 1).

In the latest online survey, conducted March 1-23, 2016, there were no major changes in the key drivers of New Zealand’s confidence. Around half (52%) said job prospects were good or excellent, 57% were optimistic of their personal finances but two-thirds (66%) did not think it is a good time to buy what they want and need over the next year.

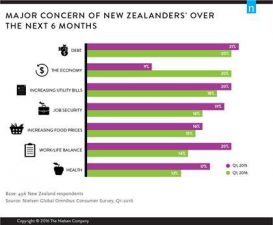

The main concern New Zealanders say they face over the next six months is debt. The economy is a growing worry, increasing by six percentage points from the previous quarter and 11 percentage points from a year ago to 20%. Increasing utility bills are also top of mind. However, New Zealanders were less concerned than they were the previous year about job security, their work/life balance and health (see chart 2).

Nick Tuffley, Chief Economist, ASB said, “New Zealanders are facing mixed influences at the moment. Weak dairy prices remain a concern for people based in dairy-intensive regions, with prices yet to show convincing signs of recovery. The start of the year brought a lot of financial market turmoil and uncertainty about the health of key export markets. Both of these sets of worries no doubt contributed to a lift in the number of respondents who are concerned about the economic outlook and who would save any spare cash they have. But the jobs market remains in reasonable shape and interest rates have once more started to fall, which will boost the discretionary spending power of borrowers.”