The ‘value’ and ‘shopper experience’ intersection

Larissa Watson, Consumer Intelligence Lead at NielsenIQ

72% of Kiwi households shop in three or more retail channels to meet their regular needs. In New Zealand’s grocery channel, 42% of shoppers will only visit one of the three major supermarkets in an average month*. This increased from 39% two years ago, signalling a move for shoppers to be more selective across the stores they buy groceries from.

Today’s savvy and discerning shoppers: While Omni shopping has grown steadily over the last two decades, the COVID-19 pandemic has certainly been a catalyst for increasing the mix of on- and offline channel usage. With more companies investing in e-commerce, the rise of meal kits and food boxes, and with a range of new ways to bring products to consumers, online channels now serve a greater purpose than just fulfilling orders. They’re now used as a way to research, compare prices, and find value. Kiwis are becoming savvier shoppers by often researching ahead of their shopping trips. Today, three in ten shoppers check supermarket websites and a quarter of all shoppers check the latest mailer to price match and keep an eye on weekly promotions^.

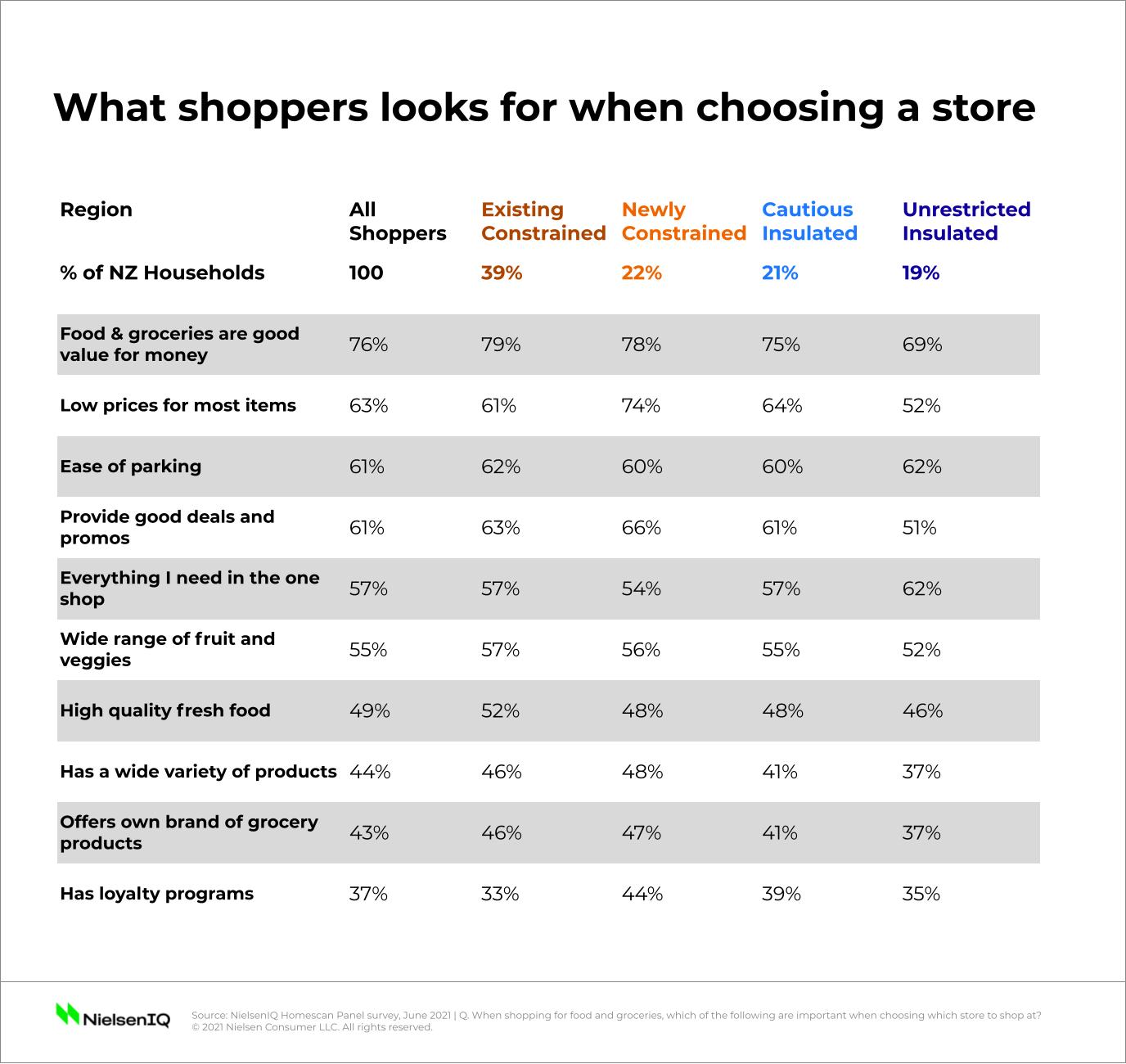

‘Value’ as an icebreaker: Three in four shoppers say they are looking for good value for money for their food and grocery purchases. In fact, value for money, low prices and good deals and promos feature among the top reasons when selecting where to shop. And, value is even more important among financially constrained shoppers, which now make up 61% of all shoppers. Furthermore, newly constrained shoppers – those who have recently experienced a worsening financial situation – are also much more motivated by in-store reward programs. 44% of this group say that reward programs are important for them.

When it comes to value, category, brand, key account and trade marketing managers need to keep their finger on the pulse with which products, brands, pack sizes and variants are important foot traffic drivers in a retailer’s overall offering. They can do this by continually updating their understanding of how shoppers select and substitute products, and how shoppers perceive price, promotion and value differently by category.

Shopper experience – the glue that makes shoppers stick: While ‘value’ is important, there are a number of hygiene factors that shoppers expect from retailers. These factors include an easy to navigate store layout, fully stocked shelves, a wide range of products, good customer service, and efficient checkout counters. When these hygiene factors are lacking, shoppers will cross-shop across multiple stores to get what they want. When they are consistently missed, shoppers will abandon a store altogether.

When faced with out-of-stocks, 34% of shoppers say they don’t buy and will try again on the next trip, 44% choose to buy a substitute item, and 22% will switch to a store that meets their needs. According to NielsenIQ’s latest consumer panel survey, shoppers are more likely to:

- Not buy and try again in categories like sauces & condiments, frozen convenience meals, chocolate/confectionery, fresh fish, and personal care products.

- Substitute products in categories like snackfoods, dairy foods, and general grocery items like canned foods, and staples, frozen meat/poultry/fish, and frozen desserts.

- Switch stores for fresh fruit & vegetables, pharmacy needs, gluten free products, vegetarian & vegan foods, alcoholic beverages, fresh fish/meat/poultry and dairy foods.

Retailers should regularly weigh up the potential share opportunities and risks of shopper leakage when choosing to range/exclude products in store. At the same time, marketers need to showcase why their brands are important for customers and what opportunity they present for retailers. Understanding shopper loyalty or ‘share of wallet’ by product/brand/category compared to a shopper’s propensity to purchase those products in one store over another is central to making informed ranging decisions.

While shoppers can have differing motivations, their overall needs are simple – they want to be able to choose between products that are affordable, high quality and convenient. What will continue changing is how shoppers perceive value, and where they are willing to compromise across the products they buy. The companies that understand brand and retailer loyalty and how shoppers make decisions will continue to be positioned for growth. To update your understanding of how consumers are shopping in your categories and for your brands, contact nzhello@nielseniq.com.

*Source: NielsenIQ Homescan, 4 weeks to 20/06/2021 vs 4 weeks to 23/06/2019.

^Source: NielsenIQ Homescan Panel survey, June 2021