Latest sales data shows Mexico’s tax on sugar-sweetened sodas has made almost no difference to buyer behaviour two years after it was introduced. So says the New Zealand Food and Grocery Council, in response to recent news from the UK, where such a ‘sugar tax’ is likely to be introduced soon.

“Pro-sugar tax campaigners continue to repeat that the sugar tax, which was applied from 1 January 2014, has been a success in terms of reducing consumption of sugar-sweetened sodas,” says FGC Chief Executive Katherine Rich.

“Apart from wishful thinking, this assertion is probably based on a published study that looked at a snapshot of data from 2014.

“This does not reflect the true situation in Mexico post the tax.

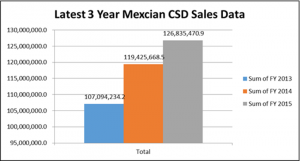

“The latest Nielsen data (below), compiled for FGC, shows sales volumes have returned to pre-tax levels.

“The slight dip in 2014 is almost impossible to see. As expected with beverage products, sales go up and down due to seasonal changes eg. people drink more in summer months.

“The overall net decline in sales of 0.39% (not even 1%) is not even one sip per Mexican citizen and is more likely to be attributed to other things going on in the Mexican economy during this time.

“New Zealand has seen a far greater decline in the consumption of sugar-sweetened sodas – a more than 4% decline in unit sales – in the same period than has been experienced in Mexico, and it’s happened here without any tax at all.

“The tax in Mexico did not create any price signal to consumers because it’s a tax on business, not a tax on consumption. As an excise tax, the additional cost gets treated like any other overhead and businesses apply it across their whole product range. The tax announced in Britain will also be a company tax not a sales tax.

“In Mexico this means that the prices of all beverages increased, including bottled water and non-sugar sodas. The tax was passed on to consumers through raised prices of all beverages (both sugar and non-sugar).

“The Mexico tax also demonstrated how regressive food taxes are. According to Kantar shopper data, Mexico’s poorest people increased their expenditure on sugar-sweetened beverages (due to increased prices due to the tax) and reduced expenditure in other categories.

“The value of the soda category (shown below x000) rocketed as prices increased beyond the initial 10% levied on companies.

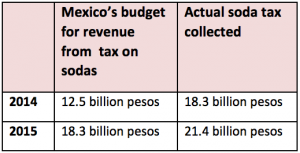

“If a government’s aim is to raise large amounts of tax, then the Mexican tax has been a roaring success. But if the aim is to affect consumption and reduce obesity, it’s been a massive failure, particularly in terms of its impacts on those on low incomes.”

Here’s what the government budgeted and collected. The money has gone into the general fund.

Other analysis of the Mexican tax can be found here:

http://www.fgc.org.nz/media/latest-sales-data-shows-mexico-sugar-tax-a-failure