Health and wellness aspirations are increasingly influencing shopper grocery behaviours. To better understand this shopper, Nielsen and The George Institute have started a new relationship to enable Australian brands to better understand the impact of nutritional information on grocery packs, such as sugar, protein, fat, calories and recommended serving size.

A first look at the nutritional data – sugar trends

Sugar content in foods is increasingly of interest to Australians; both from a health and wellness perspective, as well as price, as they start seeing the effect the UK drinks sugar tax will have on other markets. As a result, Australians are taking a greater interest in low or no sugar alternatives when grocery shopping.

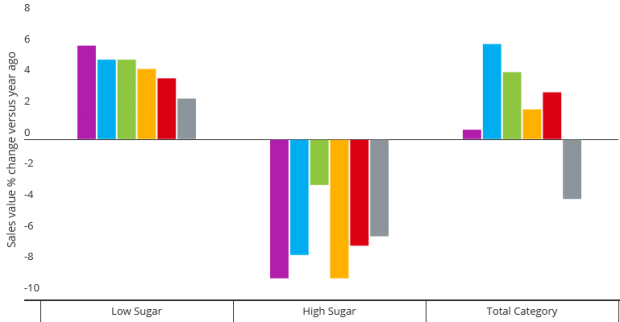

The combined Nielsen and The George Institute data indicates that consumers are already showing changed purchasing habits when it comes to sugar-heavy products. Health education coupled with more availability of healthier product alternatives are leading to Australians buying more healthy products, including low sugar options.

This leads us to the question, is a similar tax necessary in Australia, or can manufacturers play a bigger role through their product portfolio to convince consumers to be healthier?

The low sugar shopper

Nearly three-in-ten Australians are very concerned about sugar consumption. The households most concerned about sugar consumption are those with people aged 55 years or older and small households of singles or couples without children. Females (37%) are more sugar conscious than males (33%). The concern is highest in major cities, especially Melbourne and Perth.

Increasingly, consumers are willing to pay higher prices for low sugar products. More than one fifth of sugar-concerned Australian consumers are willing to pay more for low sugar products. The trend towards low sugar products appeals to an older audience, while health claims such as organic, gluten-free and lactose-free appeals to younger demographics.

Overall, the shift towards low sugar health and wellness products shows a decentralised-pattern with both lower and higher affluence driving growth. The growth is also scattered across a range of demographics, demonstrating that the search for low sugar is not confined to one type of consumer, but instead a new Australian mainstream behaviour.

Leveraging ingredients such as the natural sweetener Stevia, which can be perceived to be a healthier alternative to sugar, can help drive and sustain sales in declining high sugar categories.

In addition, savoury biscuits, dairy dips, sparkling juices, yoghurt and nutritious snacks have seen a growing consumer preference for low sugar products. For instance in 2017, the Nutritious Snacks category has seen incremental growth with 10% more shoppers choosing low sugar Muesli bars.

“As shoppers become more health conscious there are opportunities for both retailers and manufacturers to capitalise on this trend. Expanding product ranges to include low sugar or no sugar alternative offerings will open brands and categories to new buyers and also help retain shoppers that are looking to make a switch that suits their healthier aspirations.”

SARAH MCKEE, DIRECTOR OF FOOD ANALYTICS.

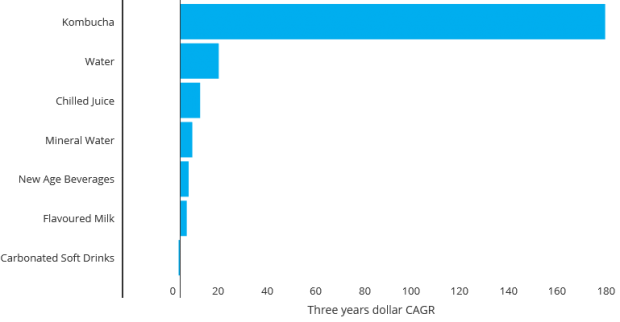

The Kombucha craze

Australian consumers are switching to perceived healthier alternatives at an accelerated rate. For example while carbonated soft drinks sales are declining, healthier options in the drinks category are all seeing growth with Kombucha drinks growing substantially in the last two years.

Leverage the health trend

Regardless of whether a sugar tax is introduced in Australia, there is a big opportunity for manufacturers to better leverage consumer needs and meet the demand for low sugar alternatives in the Australian marketplace. Looking across categories we see many areas for growth in low sugar offerings, which are also helping categories and manufacturers find growth in a highly competitive, low growth environment. With consumers being ready and willing to buy more, and increasingly pay more, for low sugar and no sugar options, the time is right for product development in this arena.

Through Nielsen’s collaboration with The George Institute, for the first time manufacturers have the ability to link actual shopper behaviour with detailed food composition, whether it’s nutrients like sugar or other ingredients, to better uncover opportunities for growth. To find out more on this collaboration, and how Nielsen can help your organisation find growth, please contact us !

By Aiste Karpaviciute, Senior Manager, Retail Industry Group, Nielsen